Here are some key performance indicators (KPI) used in real estate asset management that you will find helpful in tracking the performance of your sites and choosing between your current locations and related comps:

Operating Expenses & Occupancy Costs

-

Operating Cash Flow (OCF) – cash generated less your operating expenses

OCF = Earnings Before Interest and Depreciation

-

Capitalization rate (cap rate) – the rate of return on your investment

Cap Rate = Yearly Income / Total Value

-

Debt-Service Coverage Ratio – the amount of cash available to cover the principal and annual interest payments

DSCR = Net Operating Income / Total Debt Service

-

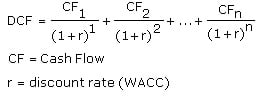

Discounted Cash Flow (DCF) – an estimate of your return adjusted for the time value of your money

Establishing the real estate asset management metrics most appropriate for your business or tenancy can help you to evaluate the performance of various locations in your portfolio, improve operations, and assess the prospects of potential new investments. Don’t make the mistake of operating by guesswork when the use of real estate asset management metrics can provide a much more solid guide to your business operations.

Here are a few other articles to check out:

5 Ways to Optimize Your CRE Portfolio

Rentable Square Feet: An Expensive Metric

4 Occupancy Cost Metrics You Should Be Using

Subscribe to our blog for more great tips!!